The implementation of ZATCA (Zakat, Tax, and Customs Authority) e-invoice software is revolutionizing the way businesses in Saudi Arabia handle their invoicing processes. This innovative software is designed to comply with the strict e-invoicing regulations set by ZATCA, ensuring that businesses remain compliant with local tax laws. By automating the invoicing process, ZATCA e-invoice software not only streamlines operations but also reduces the likelihood of errors and discrepancies.

Businesses can benefit from enhanced accuracy, improved record-keeping, and faster processing times, all of which contribute to better financial management. Additionally, the software facilitates real-time reporting to tax authorities, simplifying tax compliance and reducing the administrative burden on businesses. For companies operating in Saudi Arabia, adopting ZATCA e-invoice software is essential for staying competitive and compliant in an increasingly digital business environment.

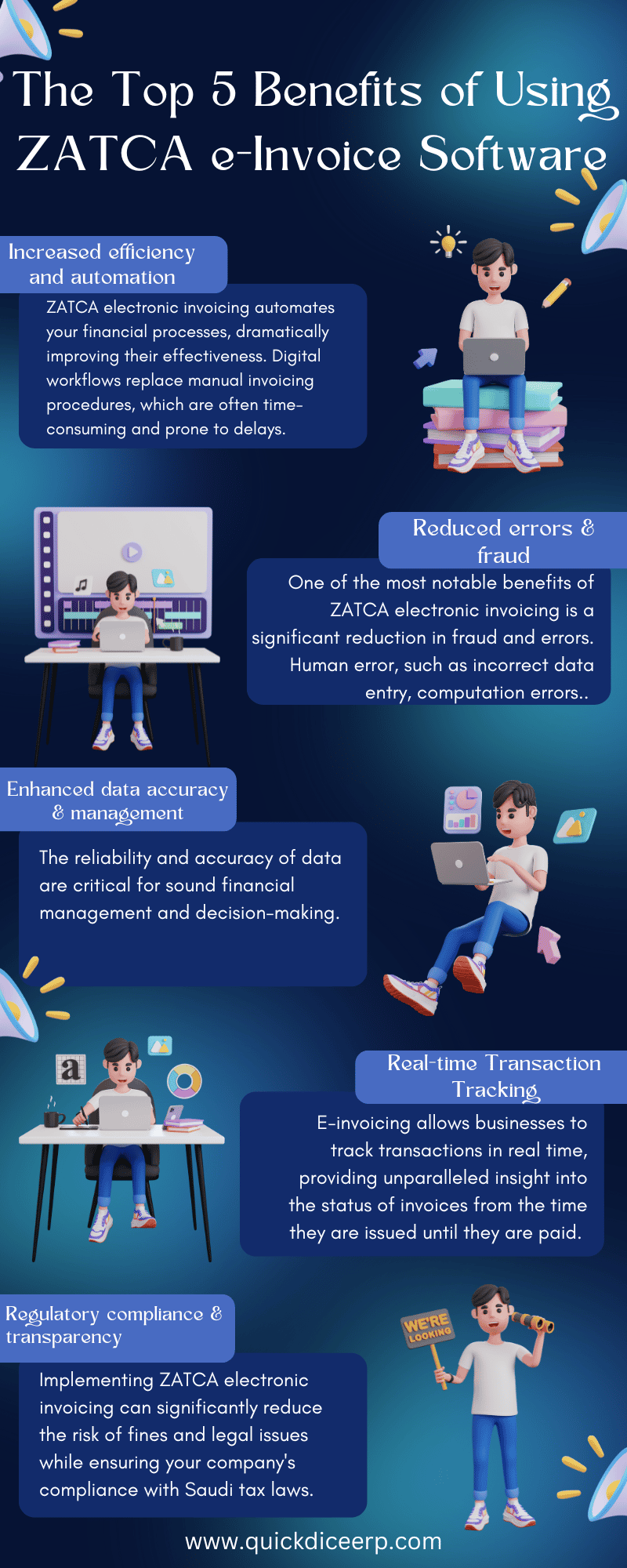

Here are some benefits of using ZATCA e Invoice software:

1. Increased efficiency and automation:

ZATCA electronic invoicing automates your financial processes, dramatically improving their effectiveness. Digital workflows replace manual invoicing procedures, which are often time-consuming and prone to delays. Automation allows for faster invoice preparation, submission, and approval, reducing the administrative burden on your staff. Employee focus can thus be directed toward more strategic tasks, increasing overall productivity.

2. Reduced errors and fraud:

One of the most notable benefits of ZATCA electronic invoicing is a significant reduction in fraud and errors. Human error, such as incorrect data entry, computation errors, and misplaced documents, can occur when invoicing by hand. E-invoicing addresses these concerns by ensuring that all invoices are created, communicated, and stored digitally in a consistent manner. In addition to reducing errors, this standardization simplifies invoice validation and reconciliation.

3. Enhanced data accuracy and management:

The reliability and accuracy of data are critical for sound financial management and decision-making. By reducing manual data entry and ensuring that information is consistently and accurately recorded, ZATCA electronic invoicing improves data accuracy. All aspects of invoice administration, including tax calculations, product descriptions, and payment terms, have improved in accuracy. Improved data accuracy enables more precise financial reporting, allowing businesses to generate insightful analytics and make informed decisions.

4. Real-time Transaction Tracking:

E-invoicing helps businesses track transactions in real time, offering clear insight into invoices from issuance to payment. With this real-time tracking feature, businesses can keep a better eye on their cash flow, identify past-due payments, and take proactive steps to resolve any issues. The transparency of real-time tracking reduces the likelihood of consumer complaints while also assisting businesses in better managing their accounts receivable.

5. Regulatory compliance and transparency:

Implementing ZATCA electronic invoicing can significantly reduce the risk of fines and legal issues while ensuring your company’s compliance with Saudi tax laws. E-invoicing solutions follow the strict guidelines set by the Zakat, Tax, and Customs Authority (ZATCA). They ensure all invoices comply with the law. This compliance increases accountability and transparency while protecting your business from regulatory scrutiny. E-invoicing builds trust among stakeholders, such as suppliers, clients, and regulatory agencies, by maintaining accurate and verifiable records of every transaction.

Conclusion

Adopting ZATCA e-invoicing software offers numerous benefits that significantly enhance the efficiency and compliance of businesses in Saudi Arabia. By automating the invoicing process, this software helps reduce errors, streamline operations, and ensure that businesses adhere to the stringent regulations set by the Zakat, Tax, and Customs Authority. The ability to generate and store e-invoices securely, along with real-time reporting to tax authorities, simplifies tax compliance and minimizes the risk of penalties. Additionally, the software’s features improve transparency and accuracy in financial transactions, making it easier for businesses to manage their accounts and maintain accurate records. As the Saudi business landscape continues to evolve, integrating ZATCA e invoicing software is crucial for companies seeking to stay competitive and compliant in a digitalized economy.